MPs and Howard Cox, Founder of FairFuelUK respond to yet another leaked predictable rumour that Fuel Duty is to rise in the Budget to pay off the Covid Bill.

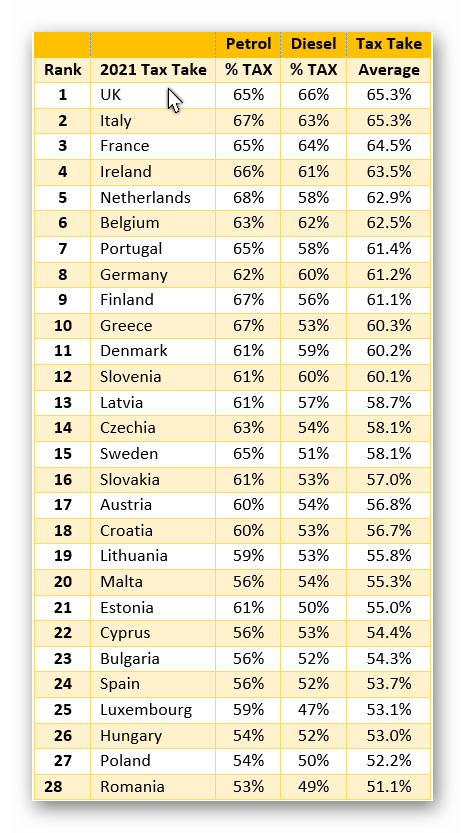

Despite UK drivers still being the highest taxed in the world (https://fairfueluk.com/Fuel-Tax-EU.png) for average petrol and diesel tax takes, the Chancellor is bullying his Tory MPs to support a rise in Fuel Duty in the Budget.

He knows the 10 years duty freeze has reduced the CPI by 6.7% and raised household real incomes, especially those of poorest households, by £24bn.

It would be a massive political folly to listen to the ill-informed well financed greens to virtue signal a needless hike in fuel duty. Worse still, it would betray the voters who gave his party an 80 seat majority, they did not vote for the Green Party.

- Robert Halfon MP says: “Levelling up must mean cutting the cost of living for working people. At a time when those on lower incomes are struggling financially, a fuel duty increase would level down – far from building back better it would damage the foundations of economic recovery.”

- Craig Mackinlay MP says: “Fuel duty rises are not supported by the public because they are bad for the economy, bad for business and bad for jobs. Motorists in the poorest 10% of the UK population already spend proportionately twice as much of their disposable income on fuel as wealthier groups so increasing fuel duty will have a disproportionate tax impact. The Chancellor must reject the green lobby’s calls and continue the successful and popular freeze on fuel duty.”

- Howard Cox says: “Rishi is risking political suicide by breaking Boris’s promise* to the nation prior to his landslide election, especially to those in the new Tory Red Wall seats, when he clearly said fuel duty would not be hiked.” (see video below).

- “A rise in fuel duty would hit the poorest motorists most. Motorists in the poorest 10% of the population (Many in the newly won Red Wall seats) spend proportionately twice as much on fuel as the richer groups. A rise in fuel duty is regressive.”

- “The way forward out of the huge economic quagmire is to incentivise not punish the very people who are at the heart of any commercial post pandemic recovery. The CEBR have predicted that a rise in fuel duty would generate extraordinarily little revenue, but most certainly would risk jobs, hike inflation, and stagnate business investment with the poorest, catastrophically hit the hardest.”

- “This pro-cycle lane and unexpectedly anti-driver Government is now blindly seeing the world’s already highest taxed drivers as the target for a quick and easy cash bonanza! Ignoring Electric Vehicles completely that enjoy free use of our roads. It’s pathologically wrong to punish diesel and petrol drivers byincreasing an already regressive tax through an ill-informed virtue signalling ideology.”

- “We will be fighting for UK’s 37m drivers every step of the way to get Fuel Duty reduced, and at worst, to remain frozen, so more money is put back into consumers’ pockets, small businesses, and the vital haulage industry.”

- “A rise in fuel duty would hit the poorest motorists most. Motorists in the poorest 10% of the population (Many in the newly won Red Wall seats) spend proportionately twice as much on fuel as the richer groups. A rise in fuel duty is regressive.”

- RHA chief executive Richard Burnett Says:

- “Last April, as COVID-19 tightened its grip on the UK, we asked industry as a whole to how it was coping. The results were startling – 50% of the UK’s trucks were laid up as a result of contracts ending due to the virus and drivers being laid off, or furloughed.

- “Those able to carry on picked up a lot of the slack and although it was never a case of ‘business as usual’ they did their absolute best to ensure that the UK didn’t go without.

- “For an industry that has to make every single penny count, the effect of a duty increase of just 1p per litre will be devastating and will mean the end of the road for many operators.

- “Last April, as COVID-19 tightened its grip on the UK, we asked industry as a whole to how it was coping. The results were startling – 50% of the UK’s trucks were laid up as a result of contracts ending due to the virus and drivers being laid off, or furloughed.

Current EU fuel tax takes in 2021. Guess who is top and has been for the last 10 years, despite the freeze in duty since 2011

Notes

In November 2020, FairFuelUK with the backing of the RHA commissioned CEBR to analyse what a 2 to 3p increase in Fuel Duty would do to the economy and Covid economic reparation.

A Top finding from the CEBR Report: “Any rise in fuel duty would generate extraordinarily little revenue.” (See all findings below)

- Douglas McWilliams, Cebr Deputy Chair and author of the ‘Fuel Duty Hike Impact’ Report for FairFuelUK/RHA said:

- “The freeze on fuel duty is gradually bringing the UK rate of tax into line with the rest of Europe. It has reduced the CPI by 6.7% and raised household real incomes, especially those of poorest households, by £24bn. Why abandon it when taxing fuel hits the poor hardest, with the North suffering most and London least?”

Headlines from the CEBR’s findings.

- Any rise in fuel duty would generate extraordinarily little revenue.

- A rise in fuel duty would create economic damage, cutting GDP by about £600 million and reducing employment by about 8,000 jobs. It would add 0.6% to the CPI (inflation).

- Despite the recent freeze, UK diesel taxes are the highest in any major economy while UK petrol prices are amongst the highest.

- A rise in fuel duty would hit the poorest motorists most. Motorists in the poorest 10% of the population spend proportionately twice as much on fuel as the richer groups. A rise in fuel duty is regressive.

- The impact of any rise in fuel duty will be cumulative. Essential vehicle users, especially LGV and HGV drivers, have already been hit recently by closed roads, closed lanes, speed restrictions, increased traffic jams and increased charges and enforcement penalties as a result of recent government action. The effects of a rise in fuel duty will be hitting sectors that already feel that they have faced an excessive increase in the burdens on them that result from government policy.

- With growth in the online sector, vans are critical to the economy. The increase in the burdens on van drivers, like those on other road users, has already started to impact on their willingness to service clients. If this continues a critical link in the service chain could break.

- The HGV sector is in a fragile situation. The average age of drivers is 55 with 13% over 60 and only 2% below 25. Profit margins are estimated at 1% only. The number of owner operators has been falling away. It is conceivable that a rise in duty could be the straw that breaks the camel’s back of this essential service.

- Cebr research has shown that the policy of freezing fuel duty, in place since 2011, has been phenomenally successful, reducing the CPI by 6.7% compared with where it would have been and boosting household expenditure by £24 billion. With a policy that has proved successful, it would be bizarre to change it.

- By 2040, fuel duty receipts will probably be less than a fifth of current levels, updating the projections above to take account of the likely ban on sales of fossil fuel-based vehicles. The current fiscal crisis is long term and will need up to 50 years of revenue raising and expenditure constraint. Given that any revenue gains from higher fuel duties will be only temporary and will evaporate over time, it seems unnecessary to take the political and economic damage from raising fuel duty in return for very little long-term revenue. The balance of advantages seems adverse.

- This means that even the relatively small, short term revenue gains from a 2p rise in the rate of fuel duty, estimated at £250-470 million from the analysis in the economic analysis section, would dwindle to £50-90 million only (at 2019 levels of activity and prices) within 20 years. As the fiscal crisis is a long-term crisis, this indicates that a rise in fuel duty has a miniscule role to play in sorting the nation’s fiscal position.

Full CEBR Report is at: https://fairfueluk.com/CEBR-Fuel-Duty-Impact—Nov-2020/index.html