Oil, Wholesale, Pump Prices Updated for April 22

Greedy oil corporations are not only failing to pass on the massive wholesale falls in petrol and diesel to UK logistics businesses, essential workers and those who have to drive, they are also failing to help small independent garages they supply to get through this crisis. Financially stretched small independent fuel forecourts have contacted FairFuelUK saying, they might not be able to cover their operational expenses due to low fuel sales and could be forced to close for good. Many are already going down and they need monetary help now from their fuel suppliers and the Government.

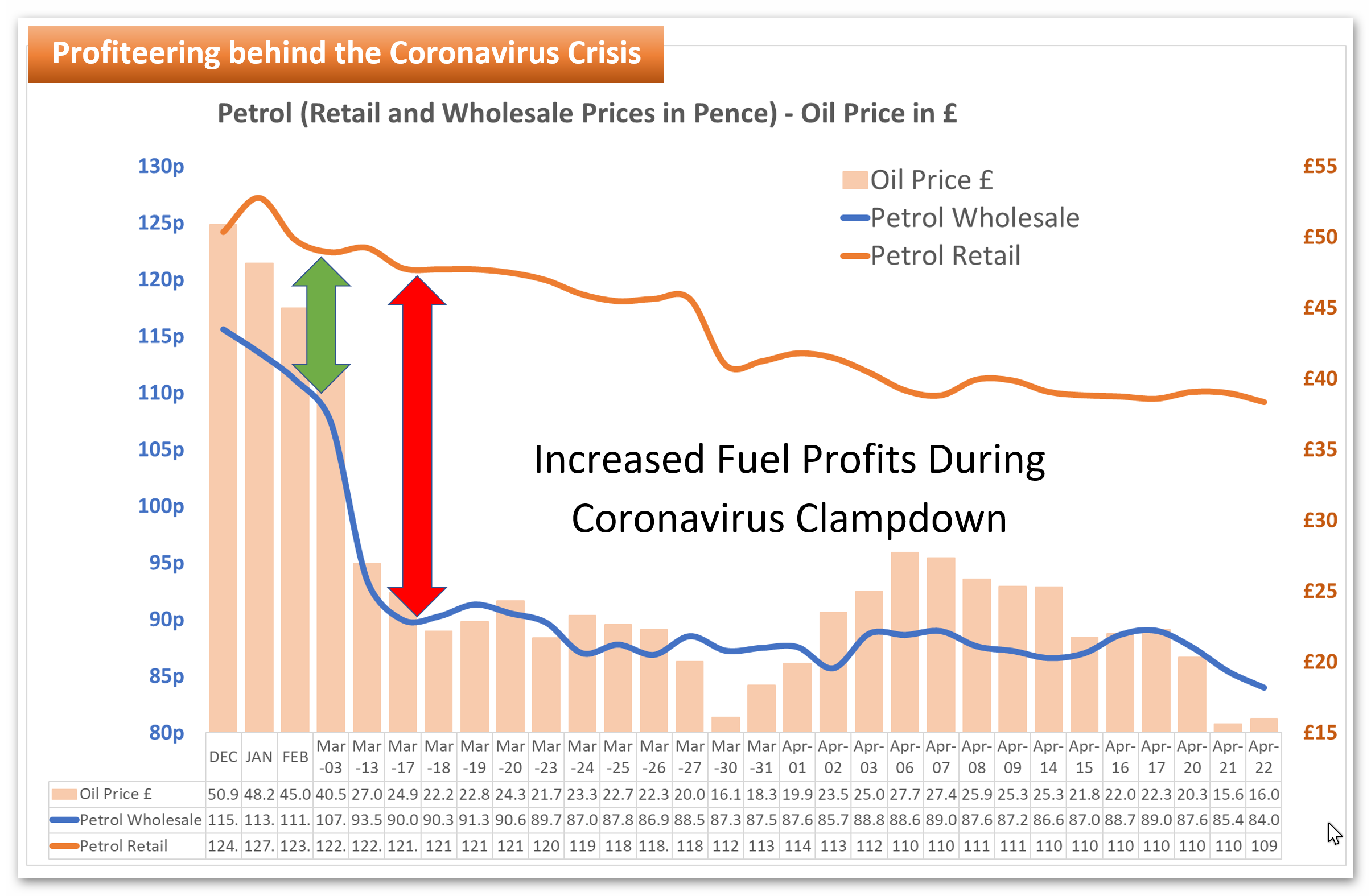

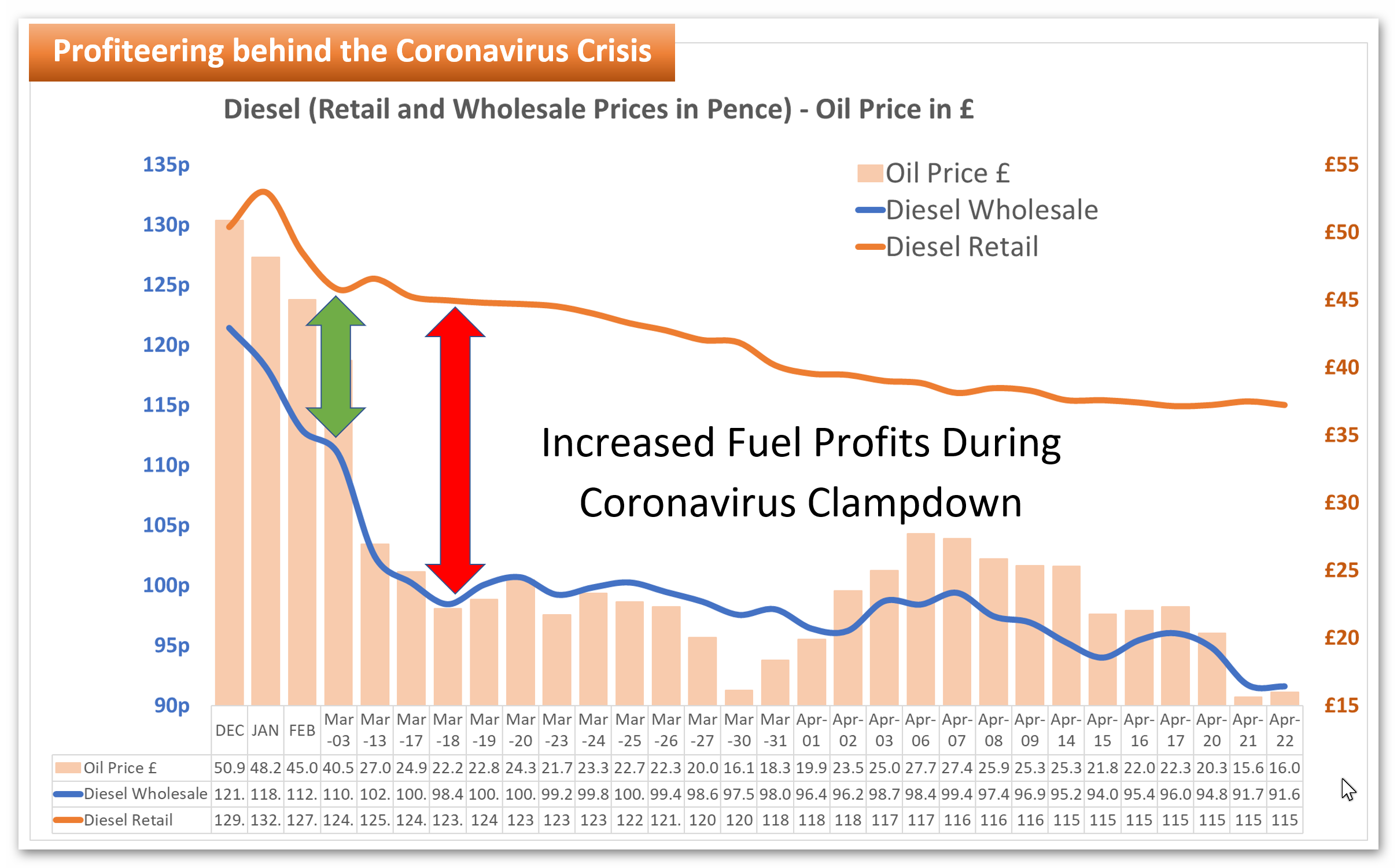

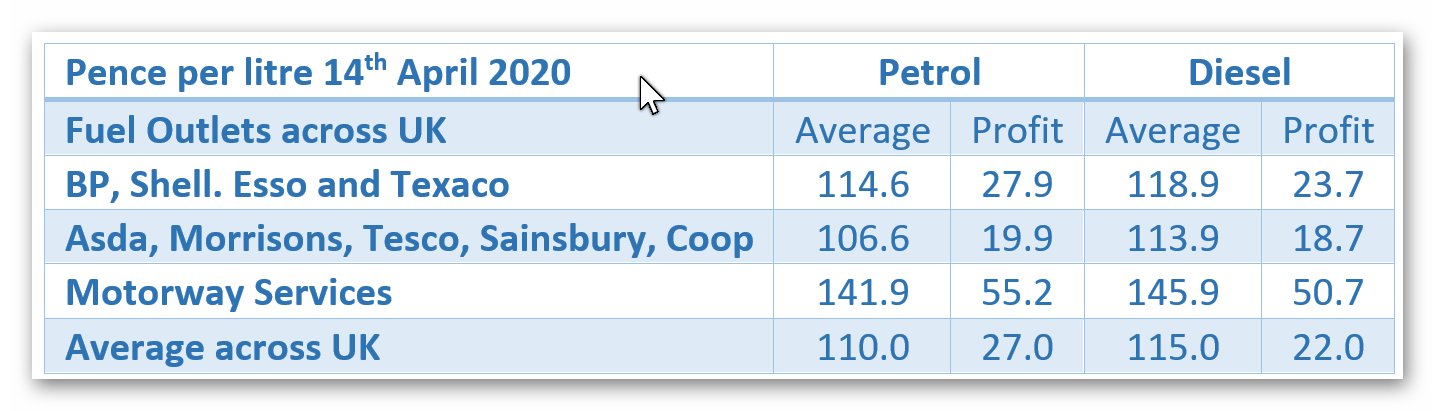

- Based on wholesale price trends and analysis of fair and honestly set profit margins, petrol should NOW be at the most 98p and diesel 106p.

- Yet, Petrol prices (22nd April), average 109p per litre with Diesel as always, averaging much higher at 115p.

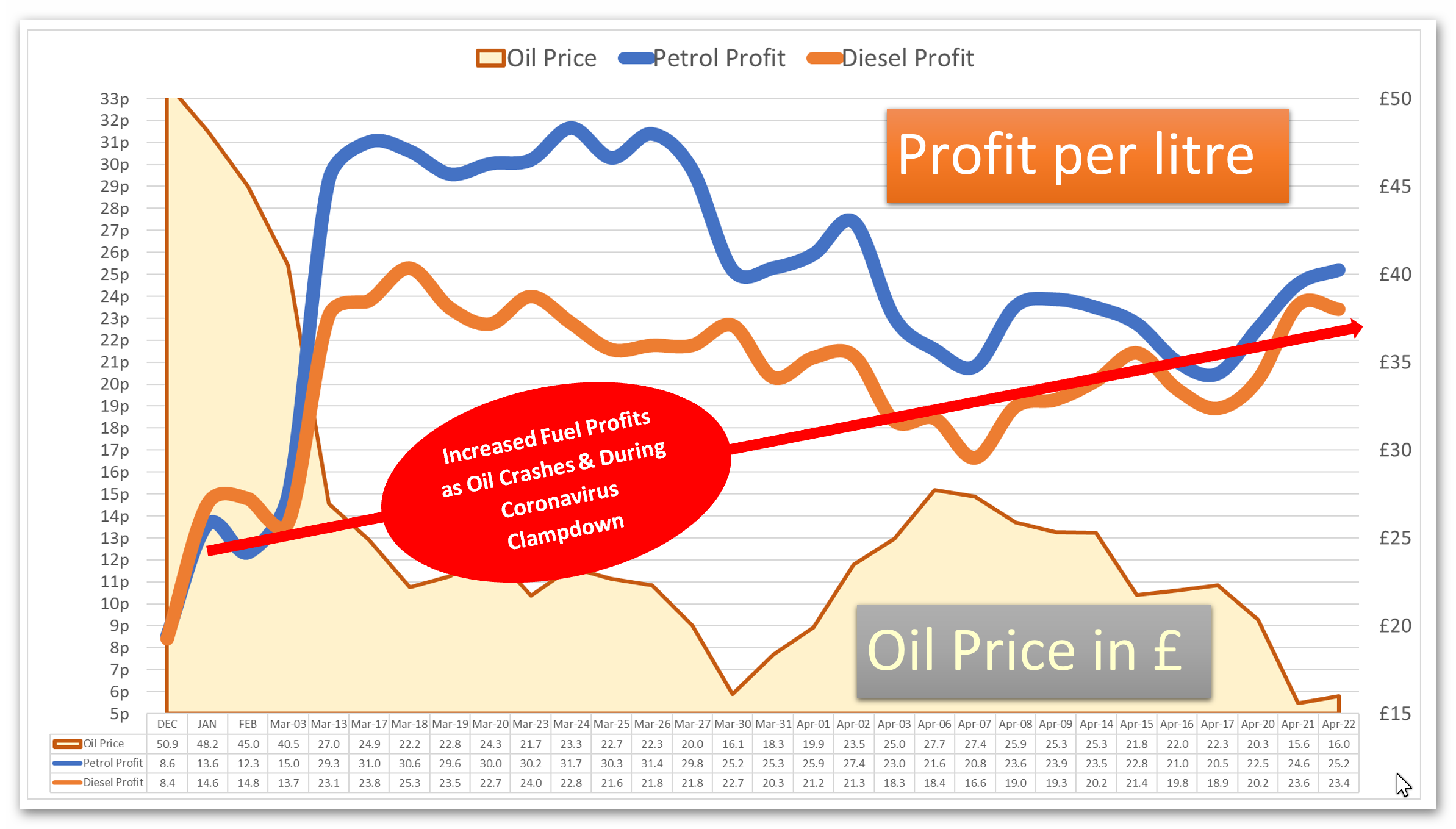

- The current fuel prices are only at this level because the big 4 supermarkets have driven down prices following March’s 50% crash in oil prices.

- If it were not for supermarket pricing fuel so much lower than the big oil firms, average pump prices would be even higher.

- The big oil company brands are traditionally always slow to follow wholesale falls in prices and never accurately reflect the right and fair prices at the pumps. They are as per normal, inflating pump prices hugely more than necessary.

- “Their profiteering is more than scandalous, it is criminal.” Howard Cox, FairFuelUK

- “When the Corona-virus is over, those who helped the war effort will be judged, those who profiteered unnecessarily, will face harsh consequences”. Robert Halfon MP

- Here is current pump price comparisons by Fuel Forecourt Category Outlets and shows the level of average profit across supermarkets, oil corporation forecourts and motorway services.

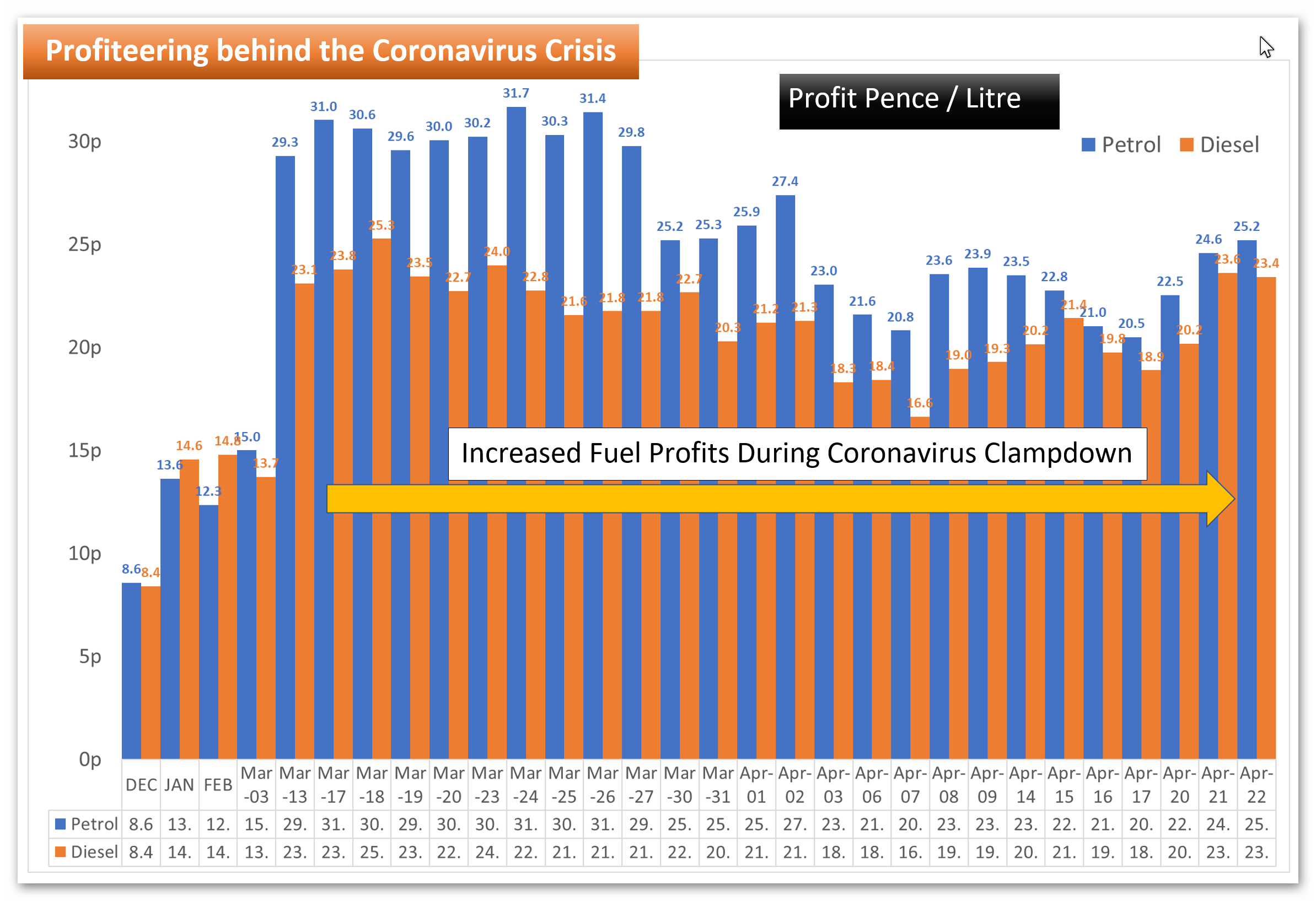

Average retail margins for December, January and February were around 10-12p per litre, yet since the CO-VID 19 lockdown, profits have rocketed to 27p per litre, that’s 125% more in deliberate profiteering. For diesel, margins have increased from 13p to 22p or nearly 70% more being fleeced from drivers.

“Now in a time of national emergency, when every family, worker, NHS professional, deliver driver, small and medium size business worry daily about their health and financial security, the big oil companies should step up to the plate. They must help the Government cut the cost or living and pass on quickly the fall in international oil prices to drivers. When the Coronavirus is over, those who helped the war effort will be judged, those who profiteered unnecessarily, will face harsh consequences”. Robert Halfon MP

“The immoral fuel supply chain has been ripping off drivers to the tune of over £20m per day. It borders on criminal behaviour, using the Co-Vid 19 crisis as a smokescreen to fleece UK’s 37m motorists even more than their normal greed. Our essential workers need honestly priced fuel, so they are not under even more financial pressure to help us all. The perennial cheating of the world’s highest taxed motorists, every time oil prices change, must be scrutinised by an independent PumpWatch body. The under-pressure Government must act now, to stop this chronic consumer abuse once and for all.”Howard Cox, Founder of the FairFuelUK Campaign

To predict what will happen with pump prices, is truly a gamble. The Coronavirus pandemic has thrown up a convenient smokescreen for the fuel supply chain to keep prices higher than necessary. They will claim that with fuel receipts down by 70%, they have a business right to fleece essential workers, hauliers and distributors of vital supplies to the NHS and those marooned at home.

FairFuelUK is mindful at this time of the pressure on small independent forecourts that provide a vital service in areas where there are no supermarkets. We dont want to see smaller garages going out of business trying to match the supermarkets’ big price cuts at a time when so few of us are driving compared to normal.

The price war that has been raging between two big oil producing nations, Saudi Arabia and Russia, seems to have been partially resolved. For these reasons we believe it is unlikely that average prices will fall much more and may ironically increase to cover the loss in volume.